REI Success Academy – Real estate investors can gain popularity and create maximum wealth only when they understand the intricacies that are involved in real estate business. Virtual real estate marketing is gaining momentum and agents can reach their objectives only when they master digital and internet marketing from zack childress who offers world class webinars, conferences and classroom training sessions to real estate investors. Zack clearly states that old methods of marketing have become obsolete after the advancement of internet technology. Real estate agents who underwent training sessions at REI success academy recently which is owned by Zack have given positive feedbacks about this trainer who has mastered flipping of homes, co-wholesaling and selling of luxury properties.

REI Success Academy – Real estate investors can gain popularity and create maximum wealth only when they understand the intricacies that are involved in real estate business. Virtual real estate marketing is gaining momentum and agents can reach their objectives only when they master digital and internet marketing from zack childress who offers world class webinars, conferences and classroom training sessions to real estate investors. Zack clearly states that old methods of marketing have become obsolete after the advancement of internet technology. Real estate agents who underwent training sessions at REI success academy recently which is owned by Zack have given positive feedbacks about this trainer who has mastered flipping of homes, co-wholesaling and selling of luxury properties.

REI Success Academy

REI Success Academy

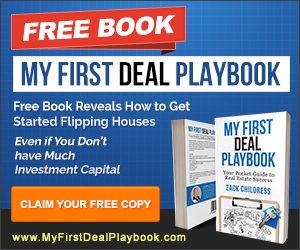

Individuals who are new to real estate investment or business should explore his official website and register for his upcoming seminars. Zack has written plenty of books that are related to real estate and his latest book on co-wholesaling is becoming an international hit. Visitors can download this book for free from REI academy site or other reputed sites. This book which is valued hundreds of dollars comes for free. This e-book is worth exploring since there are topics that are related to co-wholesaling, flipping of homes and retailing. Agents need not run behind customers when they understand virtual real estate marketing through him. Real estate executives can close the deal quickly and earn big profits when they attend his time-tested training which is extremely popular in the country of the USA.

Zack travels widely and meets hundreds of students ( REI Success Academy )

It is worth to note that Zack has decades of experience in real estate business and will teach all the intricacies that are involved in virtual trade to his new students. Investors who are longing to make five figure profits should take part in his upcoming training sessions. REI training academy which he runs successfully for the past several years has trained hundreds of students. He is an active real estate investor and loves investing his money in luxury properties. He loves virtual real estate business and offers comprehensive programs on digital marketing. Visitors who are anxious to participate in his programs should feed their names and email ids in the allotted box and wait for reply. Zack will schedule a training session immediately for the new students and teach them the latest trends that are happening in real estate business.

REI Success Academy :-

He has expertise and profound knowledge in co-wholesaling and students will get hundreds of solid info about this trade. Students who took part in his recent programs have shared their views about Zack and his sessions. Visitors should click students’ stories if they want to explore the contents. Zack is proud owner of Landmark Property Investments and Automated Real Estate Systems. ( REI Success Academy ) He has posted several free videos on the social channels which are worth exploring. Real estate investors, agents, executives and freelancers have posted their videos on his official site. Visitors can decide the next course of action after exploring these wonderful videos. This trainer who ably manages assets worth millions conducts crash course and weeklong trainings for the investors. REI Success Academy